Description

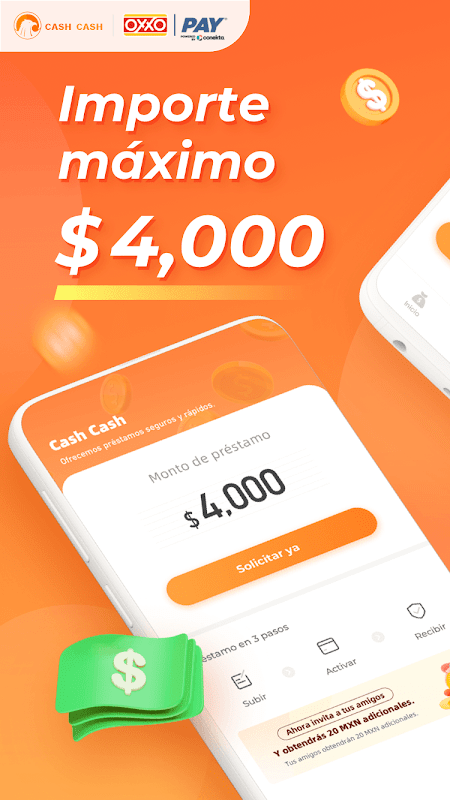

CASHCASH-Préstamos de crédito is a convenient and secure app that offers online loan services to provide urgent financial assistance to users in need. With CashCash, you can easily apply for personal loans ranging from $500 to $4,000 pesos with a loan term of 91 to 180 days. The maximum interest rate is 30% per year, and there are no service fees. We understand the importance of privacy, which is why we use digital technology to protect your data at the banking level. You can access the loan directly in your bank account without the hassle of waiting in lines or requiring a guarantor.

Features of CASHCASH-Préstamos de crédito:

⭐ Easy and Convenient: It allows you to apply for a personal loan without leaving the comfort of your home. No more standing in long lines at the bank or filling out endless paperwork. With just a few clicks on the CashCash app, you can easily fill out the application and receive your loan approval within 24 hours.

⭐ Fast and Secure: Our digital technology ensures maximum security for your personal data at the banking level. We understand the importance of protecting the privacy of our users, and that's why we have implemented advanced security measures to safeguard your information.

⭐ Flexible Loan Options: It offers loan amounts ranging from $500 to $4,000 pesos and flexible repayment terms from 91 to 180 days. This allows you to choose the loan amount and repayment period that best suits your financial needs and capabilities.

⭐ No Endorsement Required: Unlike traditional loans, it does not require any endorsement or collateral to grant you a loan. We believe in providing equal opportunities for everyone, regardless of their financial background.

Tips for Users:

⭐ Plan Your Repayments: It is important to plan your loan repayments in advance to ensure that you can make timely payments. Being punctual with your payments can increase your chances of obtaining higher loan amounts and longer repayment terms in the future.

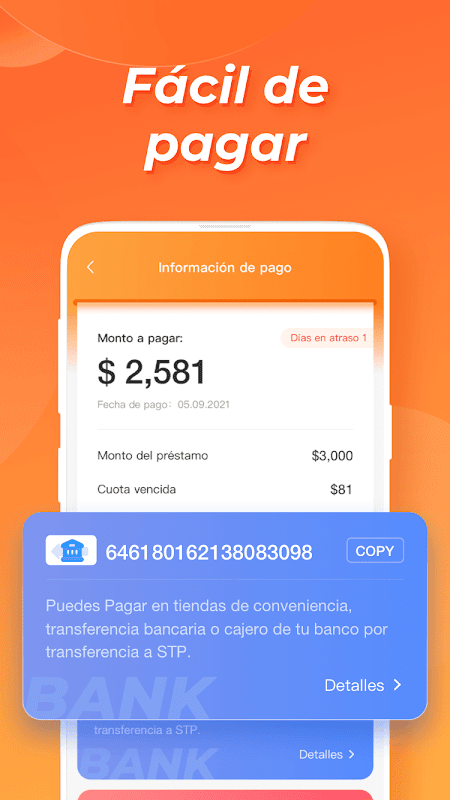

⭐ Utilize Online Payment Options: It offers convenient online payment options such as SPEI transfer, OXXO PAY, and PAYNET. These methods allow you to make your loan payments easily and efficiently from the comfort of your own home or at various partner stores.

⭐ Maintain a Good Credit History: To be eligible for CashCash loans, it is important to have a good credit history. Make sure to make payments on time and manage your finances responsibly to maintain a positive credit score. A good credit history can open up more opportunities for higher loan amounts and better interest rates in the future.

Conclusion:

With its easy and secure online application process, flexible loan options, and dedication to protecting your privacy, CASHCASH-Préstamos de crédito stands out as a leading provider of online loan services. By following our playing tips, such as planning your repayments and utilizing online payment options, you can make the most out of your loan experience with CashCash. Don't hesitate to download the CashCash app and experience the convenience of obtaining a loan from the comfort of your own home.

Information