Description

Looking to get a loan or apply for a mortgage? Look no further than the PDF Form 4506 T for IRS: Sign Tax Digital eForm! This handy tool allows you to easily access and sign the necessary documents needed to verify your financial records. By filling out this form, you give your lender permission to obtain the information they need to assess your financial situation. Whether you need to verify your income or obtain your tax information, the IRS Form 4506-T app has got you covered. Plus, the best part is that it's completely free and you can expect to receive your completed form in just a few weeks.

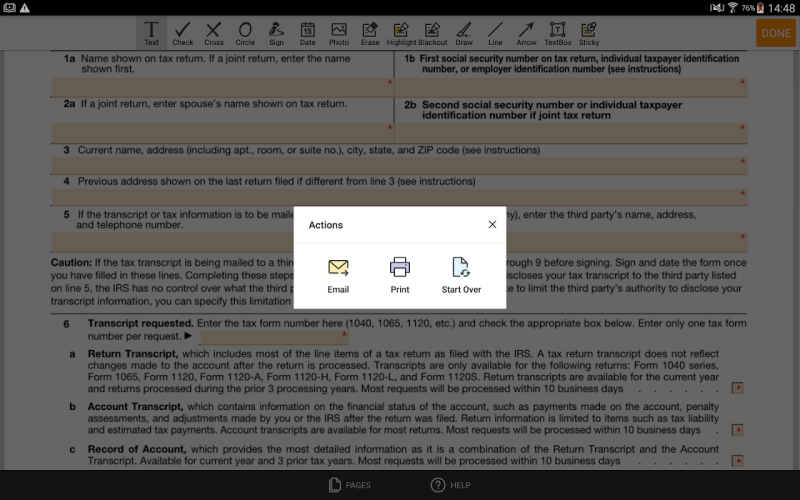

Features of PDF Form 4506 T for IRS: Sign Tax Digital eForm:

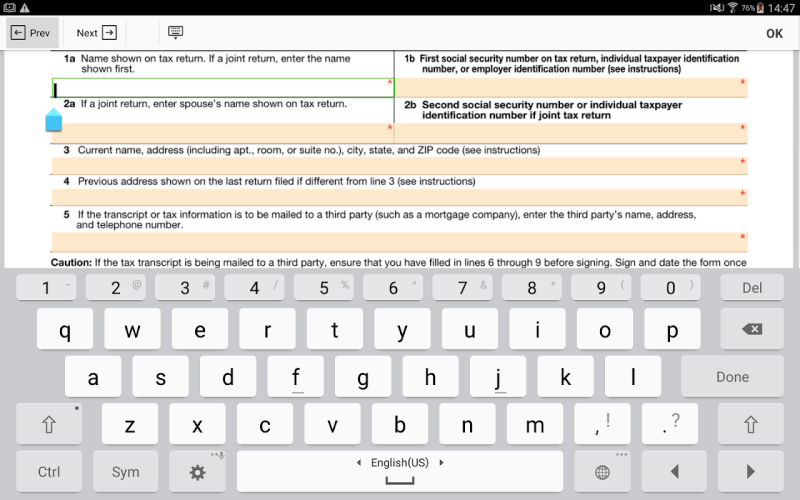

- Easy Access to Financial Records: PDF Form 4506 T for IRS: Sign Tax Digital eForm allows individuals to conveniently access their financial records, which is essential when applying for loans or verifying income. By completing this form, users can provide their creditors with the necessary information to make informed decisions.

- Verification of Tax Information: This form is particularly useful when filling out tax returns for the Internal Revenue Service. Users can verify whether they have filed a return in a specific year or request data from forms.

- Free and Fast Delivery: Unlike IRS Form - which requires payment and takes up to 75 days for delivery, the printable 4506-T form is completely free and can be expected to arrive by mail within three weeks.

- Line-by-Line Printout of Past Tax Returns: The "T" in 4506-T stands for transcript, indicating that users can expect a detailed printout of the data from their previous tax returns. This allows for a comprehensive review of past financial information.

FAQs:

- Is IRS Form 4506-T required for all loan applications?

- While it may not be mandatory for every loan application, many lenders prefer to have access to an individual's financial records to assess their creditworthiness. It is advisable to check with the specific lender regarding their requirements.

- Can I use IRS Form 4506-T to access tax information from more than the past three years?

- No, the form only allows access to tax information from the previous three years. If you require older information, it is recommended to file IRS Form - which incurs a fee and longer processing time.

- What should I do if I haven't received the printable 4506-T form within three weeks?

- If you haven't received the form within the expected timeframe, it is recommended to contact the IRS or consider requesting a new form to ensure timely access to your financial records.

Conclusion:

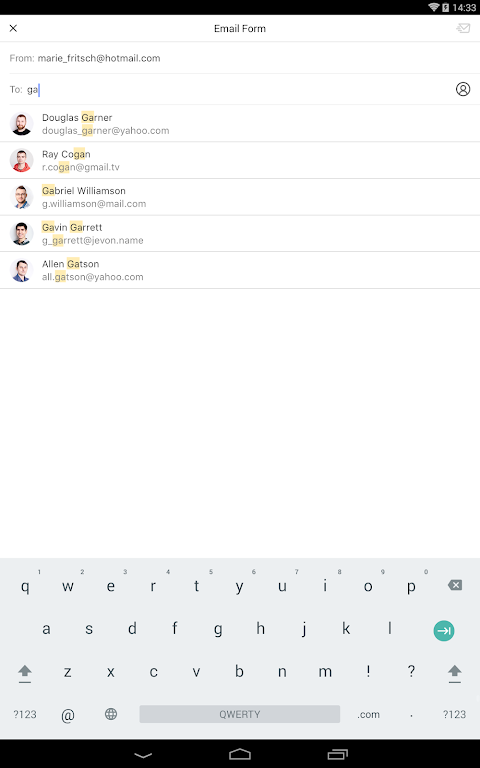

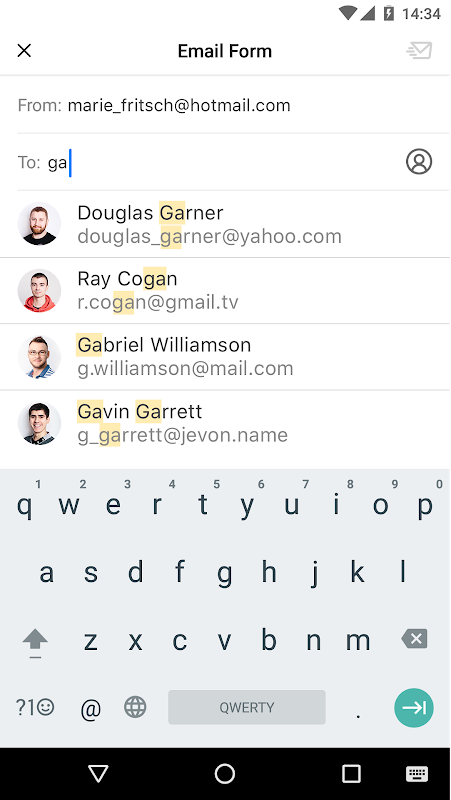

PDF Form 4506 T for IRS: Sign Tax Digital eForm provides a convenient and cost-effective way for individuals to access their financial records and verify their tax information. With its easy-to-follow step-by-step instructions, users can confidently complete the digital form, including their identification numbers, address, and purpose for the request. By utilizing this form, individuals can streamline the loan application process, satisfy lenders' requirements, and gain peace of mind knowing that their financial records are up-to-date. Take advantage of this free and efficient solution to access your financial history today.

Information